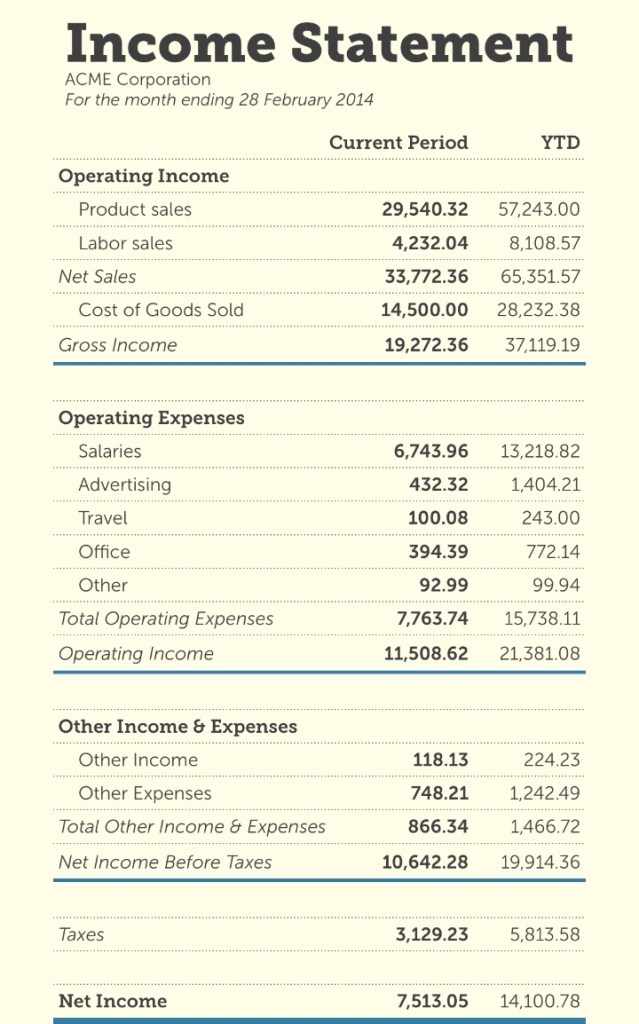

An Income statement is simply, Revenue less your raw material, less your operational expenses and having the net profit.

To simplify it for you, I always refer to the income statement as the “business payslip”.

Every entrepreneur / business person need to familiarize themselves with how to read their business income statement. It is, after all, the fundamental report for understanding financial performance over a period of time.

There are many compelling business reasons to make sure you’re able to produce an accurate income statement–beyond just understanding your net income or net loss. You’ll need an income statement for:

– loan / credit qualification

– investor contributions

– tax preparation

Additionally, the income statements provide a window into your company’s financial health and can be used to guide business decisions. Since banks, investors, and tax preparers already know what to do with your income statement–as the owner of the business, focus on understanding what you can do with it.

You really need to understand how well / bad the business is doing. For it to be a useful instruments, prepare the report as often as possible, advisable on a monthly basis. That way you are able to rectify errors were applicable sooner than later.

An income statement forms an element of Annual Financials Statement, but it’s purpose as discussed is to highlight the business performance.